“Next time” is happening right now

Since I started Good Operator, I have responded to over 1000 inquiries. A significant (but unfortunately unknown) portion of those hopped on a call with me and talked to me about what was on their mind.

By far the common topic: taxes.

This is no surprise to any of us. Of course it is. It costs you a LOT of money and is extremely confusing.

And while everybody spends a good amount of time thinking about it, stressing about it, shaking your fists in the air at it… we often don’t DO much about it. Or at least not until it’s too late to have real options.

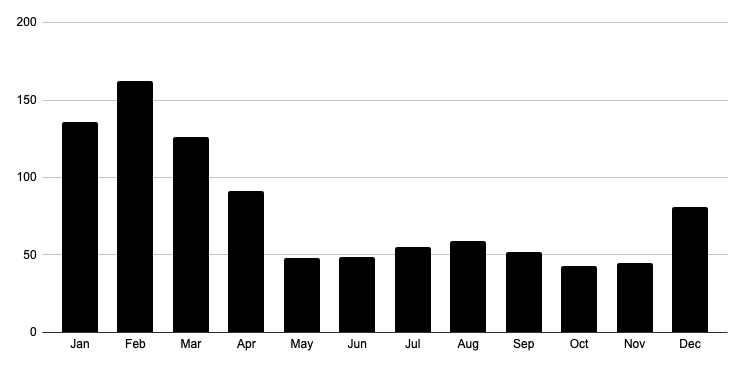

Here’s a graph of inquiries by month.

Most people reach out between January and April - “tax season”. But after December 31 what is done is done. At this point we’re just recording what happened and putting it into forms.

On these calls the common mood is overwhelmed and the sentiment is “next year I’m going to get on top of things.”

And next year this graph repeats.

But not this year. Because at one point or another you reached out to us. Maybe we had a call, maybe we didn’t, but you’re on this email list and I’m now here to remind you:

It’s time to start thinking about taxes while we still have time to do something about it.

Here is our checklist for the final 3 months of the year. This is what you need to be doing right now so that come March 15 and April 15, you’re relaxed knowing you were ALL OVER IT this year.

Action Step 1 - Get your books cleaned up.

This is pretty standard, stock advice but for good reason. I saw businesses (not our clients mind you) pay taxes on almost double their actual revenue because the accidentally double counted most of their invoices. Clean books are the first step in any tax planning & prep.

You need to make sure you’ve accurately captured (and not overstated or understated) revenue and expenses (deductions).

You need to be able to estimate your current profit (taxable income) and project the final quarter so you can ball park your income and tax liability.

You want to avoid extra fees to rush cleaning up the prior year’s books come January on.

Action Step 2 - Determine any entity changes you want to make next year

If you’re accurately capturing all your expenses, the next biggest place to save on unnecessary taxes is with a more appropriate and efficient tax structure.

Maybe you’ve been debating whether to officially form an LLC or bring on a partner. Maybe it’s time to move to an s-corp. Maybe you’ve decided you want to sell the company if a few years and need to start the QSBS clock by setting up a c-corp.

Most tax strategies chip away at the edges. Your entity structure impacts your core rates and how taxes are calculated so it holds the most opportunity.

But don’t take these decisions lightly or rush it through last minute. Plan it out now, get it into place with an effective date of 1/1.

Action Step 3 - Check in on your “reasonable” salary for S-corps.

If you need to make adjustments here, either by pulling back your salary or adding to it, you want to do that now. It’s easier to plan over 6-ish or so payrolls rather than shoving a large payment through at the end OR paying extra payroll taxes you don’t need to over the final quarter.

But do this intentionally and with planning because this can be a big red flag for audits.

This is one it helps to have someone helping with.

Action Step 4 - Estimate taxes and set aside funds

Remember those nice clean books you got sorted? Let’s forecast that out a bit to see where you’re likely to end up and run that against last years tax rate. OR you can get more scientific with it and run a draft return. But let’s keep it simple for now.

Come up with a ballpark tax liability, compare against what you’ve paid, and make sure you have enough set aside.

The biggest pain point we see come January is a tax bill you knew was likely but you pushed off and now don’t have the cash.

Action Step 5 - Tax mitigation

I’m guessing this is section you were looking for when you opened this. And I’m probably going to disappoint you because the really clever stuff requires a) a LOT more time and planning than 3 months, b) likely a lot of lawyers, and c) only works/pays for itself when you’ve got 7-figure tax obligations.

But let’s talk about the very real, very meaningful things you can be doing.

If you’re using cash basis accounting, push cash collections into January for projects that won’t have associated expenses until the next year.

Same for expenses, consider prepaying or front loading costs into the current year.

Maximize any tax efficient investment accounts like your 401k, SEP IRA, etc.

Identify areas of investment for growth next year and spend it now. It’ll reduce your taxable income and prime you for a big year ahead.

Of course there are more specific things on a case by case basis so talk to us about finding some other ideas.

(And then let’s talk about how to get you generating those 7-figure profits)

Action Step 6 - Collect documents ahead of time

It’s not just about paying taxes - you’re also going to have to send out 1099’s and W2’s so make sure you’ve got things set up to do that.

Collect W9’s from any contractors you’ve paid more than $600 to. And this can take some time to corral so I’d start now…

Action Step 7 - Find your accountant

There’s a big shortage of accountants right now and they have finite bandwidth during tax season. If you’re looking for someone in March, there’s a good chance the ones you want to work with are booked up.

If you reach out now they can start learning your situation, your business, and help you plan for next year as well as be early out of the gates so you get that refund quickly.

We book up fairly early and we’d like to help get you a plan for the next 90 days so if you’d like to work with us - now is a good time to have a conversation.

We’re officially launching our most exciting tax product.

We’ve taken a lot of calls and we heard you.

You want more personalized support. You want a proactive partner. You want someone seeing around corners and you want to sleep knowing you’ve done enough.

Well we’ve taken the hint and spent the last several months working on a new offering that combines the proactive, great service of our accounting products and applies it to TAX.

If all you need are basic returns - no problem. We got that covered.

But if you want someone working with you to proactively plan and build a more tax efficient machine - it’s here.

Let’s make this as stress-free of a tax season as possible.

Best,

Chase “Action Steps” Spenst