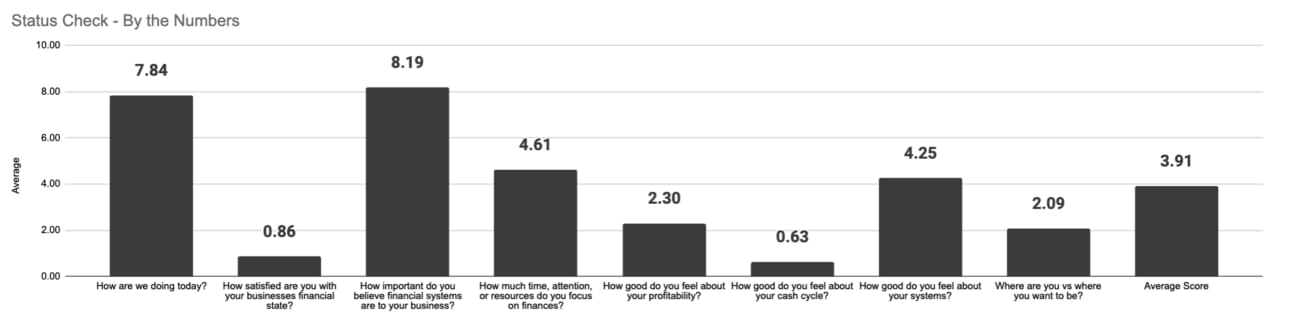

In a workshop not too long ago I took a survey at the beginning of the session to see the general sentiment of our group. Small samples, but I have found this to be a common theme.

On a simple 1-10 scale, I asked about these entrepreneur’s relationship with their finances. It’s hard to read so I’ll list out the questions and scores:

How are you doing today? 7.84

How satisfied are you with your businesses financial state? 0.86

How important do you believe financial systems are to your business? 8.19

How much time, attention, or resources do you focus on finances? 4.61

How good do you feel about your profitability? 2.30

How good do you feel about your cash cycle? 0.63

How good do you feel about your systems? 4.25

Where are you vs where you want to be? 2.09

And the average score across all those was 3.91

Here’s what’s interesting to me but not all that surprising:

The perceived value of financial systems: 8+. Time spent on it: 4+. Results: 0.6-2-ish.

People know it’s important, put SOME but not proportional effort in, and are unhappy with the results.

Why?

They don’t know how.

Operators don’t know how, don’t have the practice, and subsequently don’t have the comfort with using financial systems to improve their business. So it’s avoided and the results for any work done is disappointing.

I bet if more operators KNEW exactly what to look at and felt confident in how to USE the numbers, they would, and they’d experience better results.

We’re going to go over how to better use financial tools to improve your business.

Not just how to save money either. How to grow, how to improve margins, how to generate and manage cash, all using “the numbers”.

It starts with decision making.

Every day you’re deciding where to spend your time, where to add more resources, who to hire next, what products to develop, on and on, one decision after another.

Execution is what gets the results, but decision making and INTENTIONAL execution is what determines the impact of those results.

And I have a theory as to who the best decision makers in the world are:

ER doctors.

Think about it. You are facing the most challenging of environments - chaotic, relentless wave after wave, and you’re dealing with people one what is probably their worst day - and have the highest of stakes - life or death.

I can’t think of another occupation that is more practiced at intense decision making than that.

I can’t use real ER examples obviously so we’re going to take the next best thing: a tv show being celebrated as the most realistic view into what happens in an emergency room on their toughest day.

HBO’s The Pitt

First of all, no spoilers here. Second of all, to be perfectly, 100%, no-doubt-about-it clear: I would never compare the day of an agency owner or Saas founder to that of an ER physician.

We’re just here to learn how they do it and see what we can take from it.

So here is my guide to making decisions like a rockstar ER doctor:

Know your priorities

“Resuscitate then diagnose.”

A line one of the physicians states as they’re dealing with an unknown illness in a patient and from it we draw our first lesson. Know your priorities.

Understand what is important for where you are and the order of importance for where you’re going.

You cannot do everything everywhere all at once. Each decision may have multiple options that are all “right” for different reasons. We need to understand what outcomes to prioritize otherwise it’s easy to spin between a bunch of similarly good or bad options.

If one decision leads to higher growth and the other higher profitability, there isn’t a right or wrong answer. The only way to make the call is to understand what is more important to you at this stage.

Same goes for things like highest potential outcome vs most likely to succeed. We need to know if we’re prioritizing likelihood of success or total peak potential.

Understand going in what is most important to you.

Start with curiosity, collect information

You never go straight to treatment. Begin with questions and seek to understand.

Over and over, the medical students are taught to ask questions, lots of questions, of the patient, of the family, of the EMS team that brought them in. It is NOT to come in with a pre-held position and start doing stuff to the patient.

Approach with curiosity, collect GOOD information, form a hypothesis, and run tests to confirm or disqualify it.

Good information is:

Accurate

Relevant

Timely

How do we apply that?

Keep your financials up to date and accurate.

Make sure you’re using relevant metrics such as when you should be looking at cash flow instead of profits, understand cash vs accrual

Track and allocate expenses to projects or departments or whatever categories are relevant to your business

Let’s take a common example we hear: “I don’t know when I should/can hire someone.” High stakes, wait too long and you’re in trouble, hire to early and it’s expensive.

Good information would look like:

Current revenue trend

Current variable cost structure and forecasted labor needed

Current fixed costs structure and forecasted expenses

Expected salary cost including payroll tax, benefits, etc. all in

Simply put, how much are you making, how much do you expect to make in the near future, how much are you spending, and how much do you expect to spend. Then add in the estimated cost of the new hire.

Sounds simple but how do we know what revenue will be or what if we’re considering a couple of different hires with dramatically different rates?

Which brings us to…

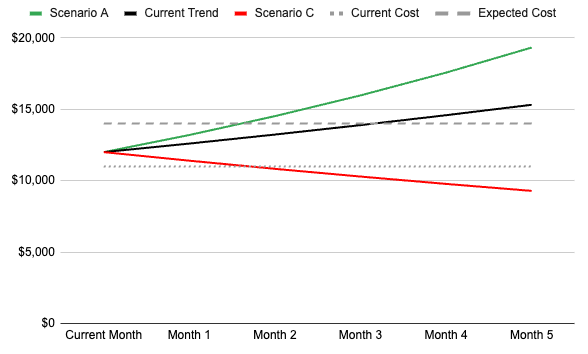

Think in terms of scenarios

We like things definitive, clear cut, black and white but decisions and their impact are rarely binary.

In the ER, you’re always working with a range of possibilities that could mean dramatically different things for our outcome.

You have to think in terms of scenarios.

There’s two parts to this.

First, understanding what the scenarios are, what the potential impact is, and to any extent possible, how likely they are.

There are some situations that are highly unlikely but catastrophic so they can’t be dismissed. There are other situations which are

It’s important to be objective here. As an entrepreneur, you’re already in a fairly optimistic group. You wouldn’t have started a business with an overly pessimistic perception of the world. As such, it’s not hard for entrepreneurs to downplay the downsides and overestimate the likelihood of their best case scenarios.

You need to fight this and lay out reasonable expectations. That doesn’t mean you don’t take any risks. There may be upsides so high that you absolutely should pursue it. But you need to go in understanding the potential and planning accordingly.

The second part is understanding what has to be true for each of these scenarios to exist. This does two things. It identifies what external forces and conditions need to exist so you can be aware and make judgement calls on how likely they are to happen. It also identifies what is required of you to achieve one scenario or another.

With our hiring decision, we’ve roughly mapped out the expected revenue and costs to see if we can afford this position but we acknowledge that’s a guess.

Revenues could be much higher. They also could stall or decline.

It’s unlikely they would go to $0, but maybe a 10% dip isn’t uncommon. It’s also unlikely a wave of new business will come in out of the blue and double revenues next month, but it’s possible if you close most of the pipeline to grow 20%.

So what does the new hire look like with a 10% dip and what does it look like with 20% growth?

How likely do you think those are?

What needs to happen in order to meet the minimum for success - say 10% growth? How confident are you that you’ll hit that?

If you need a top 10% outcome for this to work, maybe it’s too aggressive. If under conservative assumptions, at worst this breaks even with the potential to be very beneficial, sounds reasonable to proceed.

Acknowledge you won’t KNOW anything 100% for certain.

Even if your odds of meeting that minimum amount of growth needed is 90%, you still will miss 10% of the time. That doesn’t make the decision a mistake. It just means it didn’t work out this time and now you have to figure out this new problem.

Hopefully that helps you be more prepared to execute on a successful scenario but also gives you peace of mind that when things don’t go your way your process was sound and the decision was good.

Let’s say that another way to be clear:

Good decisions don’t always lead to good outcomes.

It doesn’t mean you shouldn’t have made that call. It means if you make it 9 more times you should win them.

Be careful, though, because running through scenarios can quickly create its own pit of quicksand.

So we need to…

Know when to take action

In the ER, curiosity and collecting information is important in taking informed action. If you act with incomplete information you risk a mistake. You might make the injury worse, you might create a new issue altogether.

But. Seeking perfect information and failing to act is as harmful or worse. Doing nothing isn’t an option in the ER.

You will never have ALL of the information, so how much is too much and how much is too little?

Think in terms of DIRECTIONAL instead of PRECISE.

You don’t need to know that the margins on this product or 22.8% vs 21.3%. You DO need to know if it’s +10% vs -5%.

If you’re looking at a decision and additional information could change dramatically your decision, try to collect more. If more information won’t meaningfully change the call, it will only effect the degree to which something does or does not happen, you can move forward.

In our example, if we take average revenues and expenses going back 3 months, layer in some growth based on the state of the pipeline, and look for any big one time costs coming up, that’s probably a good start.

Now, if we look for ANY one-time costs we might have missed including a $50 dinner or a $200 annual subscription, does that change anything? Probably not. So once you’ve covered all the $1000+ items, move on.

If 15% growth vs 20% growth doesn’t change much, don’t dig deeper into trying to accurately predict which it will be.

But. There’s a good chance that the pipeline has some big questions in it that you can’t collect more data on. If one deal closes, it’s 30% growth. If it doesn’t, its a 10% drop.

How do you move forward when the scenarios vary widely, you can’t collect more information, but you need to take action?

Be prepared to iterate, adapt, and change course

Part of moving forward decisively in an Emergency Room is having the confidence that you can fix things. You won’t get it right on the first shot every time so part of the process is to maintain options throughout and iterate quickly.

If that 5% outcome happens and you now have a new problem, don’t get discouraged at the “failure”. That’s part of the process. Your decision making was sound, you just have a new challenge to deal with so do so.

Regroup and tackle this new thing.

Even when things go right, you’ll have a new challenge on the other side of this. It’s just a different challenge. So acknowledging that your job, in success and failure, is just responding to one challenge after another.

Go back to your scenarios and what has to be true for these outcomes to be achieved and focus on adapting to the new information, the new external environment, and your available options for action.

Maybe you didn’t get that 10% threshold you needed to cover the cost of the new hire and now you’re losing money.

Reassess the potential and timing where you would hit that 10% and start considering options of places to cut short term to avoid having to let the new hire go. Use some emergency reserves, delay some other spending, cut some nice-to-haves.

Keep options open, adapt, iterate.

Growth requires risk

If you’re growing your business, you’re assuming risk.

If you’re assuming risk, you need to be making good decisions.

Good decisions require information and your financial systems become more than a box to check at tax season. They become an asset for growth.

And this is how.

In the coming weeks I’ll be showing specific examples of how to use your numbers for growing your business and profits and we’ll work on getting you reps so you’re more comfortable and confident.

If you’d like to jump ahead to the part where you just HAVE it, then reach out to us about setting up better accounting, cleaner books, and better information. Not to mention a dedicated expert working through this with you.

We’d love to work with you and your business.

Best,

Chase “no relation to Noah” Spenst

Let’s work together: